IN THE PURSUIT OF HAPPINESS : SLOW AND STEADY WINS THE RACE

- Sun Jul 07 18:30:00 UTC 2024

- In Case Studies by Aparna Bose

CASE STUDY 6

Client Profile

Client: low income, impulsive spender, individual and/or joint goals missing, service, self-employed

Situation:planning to invest despite low or very low income, needs help of experts with allocation of funds, needs guidance on budgeting and organizing portfolio

We all know that financial stability is important because it means we have enough money to pay bills, pay off loans, pay for education, spend on elderly care, plan vacations, so on, so forth. Above all, properly managed money provides much-needed peace of mind and a strong durable safety net for our family. But when you are living paycheck to paycheck, on a very low income or stuck in a low paying job or battling inflation, either way it may be hard to make progress towards your goals. In other words, where income often supersedes the expenses, to meet any unexpected expense can seem to be a herculean task.

At Investaffairs, we always tell people who are running the show on a tight budget, navigating the choppy waters of financial instability and budgeting on low income, that they are not alone. Income or bank balance is not an indicator of self-worth. We all struggle financially at some point or the other. Does that mean one should give up and leave everything on fate? Or should they sit for a while, take a few deep breaths and take stock of the situation? Or better, be more prudent and seek professional/ external help? Budgeting on a low income is not a rocket science, it is absolutely achievable with effective budgeting and strategizing as- “The easiest way to manage your money is to take it one step at a time and not worry about being perfect- Ramit Sethi”.

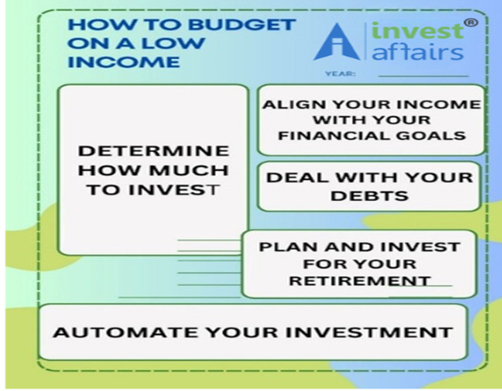

Every budget starts with a person’s income. While addressing this particular category please know that we are not just talking about the single income households but also the double or multiple income households. So, when you come to us your first task comprises of listing all the sources of income followed by figuring out and writing down all the expenses. Please do not hide anything from your personal finance manager, very similar to what we say about not hiding anything from your doctors or lawyers.

Please understand that writing down even a minutest expenditure matters, so try not to miss out on anything. List all your bills, expenditures on food, movies, gas, maids, driver etc. etc. Our experts always encourage the ‘prospects’ to share as much information as possible because it helps them to optimize their investment planning. Following this exercise, you may or may not choose to be a part of Investaffairs family but rest assured, once you have visited us and shared your finances with us, it will be treated as confidential no matter what.

Often a client fails to differentiate between the needs from wants, which is taken care of by our experts. What needs to be done on a priority basis is to take care of what we call the four walls of expenses: FOOD, UTILITIES, SHELTER AND TRANSPORTATION. To understand the significance of the sequence, one must keep in mind that during adversities priority should be to buy food and then pay a debt. After the four walls are covered budget for other expenditures, something in the lines of a miscellaneous category for expenses which you know will pop up, suddenly and unexpectedly.

Taking this exercise further, our experts will subtract your expenses from your income to reach a point where you will get either a zero, meaning that every penny that you are earning is being utilized or consumed. In case you get a negative score, there is nothing to feel bad about it. The entire idea behind this task is exactly this, that is to save yourself from overspending.

HOW?

Be more rational and intentional about your spending habits and prepare yourself to make some sacrifices. Seek professional help, because you need it. With a low income, more hard work, stress at work, targets to meet and responsibilities to shoulder, you certainly need someone with financial expertise and experience to plan your cash flow. Sit with your spouse and your personal finance planner and identify what costs you can cut out. This exercise is very healthy and mandatory for everyone, not just for people with low income or negative net worth.

The extra or unnecessary expenses may include activities like visiting a parlour twice or thrice every month, spending on expensive nail art (easily avoidable). We usually skip them while planning our household budget but when we finally do this exercise and add the money spent on them, we realize why they are so crucial for financial planning. You may try to scale back on expensive weekly outings, scale back on restaurant visits and several other similar expenditures. You can reduce the negative impact of impulsive buying, almost always stimulated by an unexpected need, to avoid any kind of major financial setback.

It is crucial to comprehend that investing, or what we term as long-term wealth building, is not a scheme to amass wealth rapidly. Instead, it is a prolonged strategy that necessitates focus, dedication, and discipline. While initiating investments early sets a strong foundation for a well-structured portfolio, it is never too late to secure a lifetime of financial stability and opportunities. The size of the income or corpus is inconsequential—any amount is sufficient to commence investing. What holds paramount importance at any stage of life is the intention. A well-guided investment strategy can significantly differentiate between a comfortable retirement and financial hardship in old age.

CONCLUSION:Financial stability is crucial for managing expenses, planning for the future, and providing peace of mind. Living on a low income or struggling financially is a common challenge that many people face. Seeking professional help from boutique firms like ours (Investaffairs) and being intentional about budgeting and spending habits can lead to financial improvement. It is essential to be mindful of unnecessary expenses that can impact financial planning. By cutting back on non-essential activities and impulsive purchases, one can take significant steps towards securing a stable financial future. Investing for the long term requires dedication and discipline, and it is never too late to start building wealth. Regardless of income level, the key is to have the intention and commitment to make informed investment decisions that can lead to a comfortable retirement and financial security in old age.

#Investaffairs #LowIncome #FourWallsOfExpense #CashFlowPlanning #ImpulsiveBuying #WealthBuilding #RetirementFund #LongTermPlanning

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts